Browse US Legal Forms' largest database of 85k state and industry-specific legal forms.

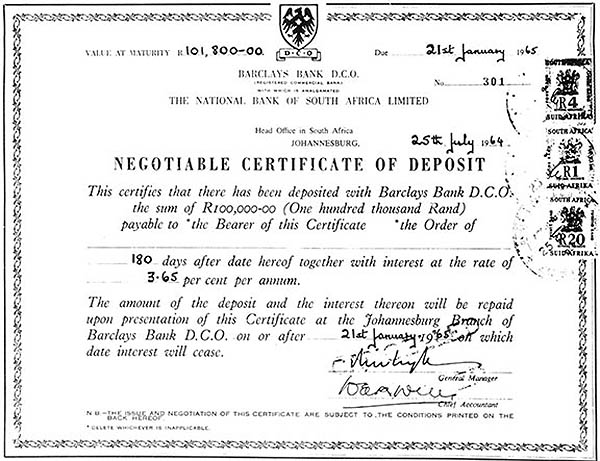

Negotiable Certificate of Deposit (NCD) refers to a large time deposit in a commercial bank. Distinct from a smaller time deposit, NCD cannot be redeemed early but is negotiable so that it can be sold to others. The maturity and rate paid on an NCD is generally negotiated at the time of issue. Maturities of an NCD range from two weeks to twelve months.

Legal Definition list

- Negotiable Certificate of Deposit

Related Legal Terms

Legal Definition list

- Negotiable Certificate of Deposit

Related Legal Terms

Also known as NCDs, negotiable certificates of deposit are fixed deposit receipts that can be sold in a secondary market. Unlike other CDs, this type is structured so that the holder of the security can sell it to a third party. Like all types of CDs, it cannot be cashed until the security has reached full maturity, even if the asset is sold.

Most banks that offer the option of a negotiable certificate of deposit require that the security has a minimum face value. While the minimum face value required is generally $100,000 in United States dollars (USD), it is more common for this type of CD to carry a value of $1 million USD or more. In addition, the terms related to this type of investment normally provide for interest payments to be applied every six months, up to the point that the security reaches maturity.

Negotiable Certificate Of Deposits

The bank issuing this type of investment product normally guarantees the security, and is likely to arrange for its sale on a secondary market. Large institutions are the most common buyers of this type of CD, and may use the asset as a means of generating some amount of additional return on the money invested in the purchase of the negotiable certificate of deposit, while not tying up those funds for extended periods of time. Generally, the strategy is to acquire the CD when it has no more than a year left to reach full maturity, thus allowing the new owner to enjoy a decent return in a relatively short period of time.

Negotiable Certificates of Deposit. Negotiable certificates of deposit or commonly abbreviated as NCDs is a short term to medium investment. They are bearer instruments and are also negotiable securities. Negotiable Certificate of Deposit (NCD) Details. Product Feature. NCD is a time deposit type financial product which is issued by discounting interest on deposit in advance and can. All of the following are true statements regarding short term negotiable certificates of deposit EXCEPT: the minimum denomination is $10,000 (its $100,000) On customer account statements, long-term negotiable certificates of deposit. Negotiable Certificate of Deposit. The following requirements and benefits are available with this deposit instrument: A minimum amount of N$1. Jumbo CDs are also known as negotiable certificates of deposits and come in bearer form. These work like conventional certificate of deposits that lock in the principal amount for a set timeframe and are.

Negotiable Certificate Of Deposit Adalah

Because a negotiable certificate of deposit can be sold repeatedly, an owner can choose to offer the asset on a secondary market as a means of generating quick cash in the event of an emergency. For example, if a business that had invested in several NCDs should suddenly need money to rebuild production facilities that were damaged during a flood or other natural disaster, it would be possible to sell those assets and use the money to effect the repairs, without using a line of credit or waiting for any resulting insurance claims to be settled. While losing on some of the projected return associated with the assets, the company may find that selling the NCDs is the most cost-effective way to restore operations and protect the profit margins of the business. This is particularly true if the alternative would be to create debt that would carry a higher rate of interest than the interest lost by selling the NCDs.